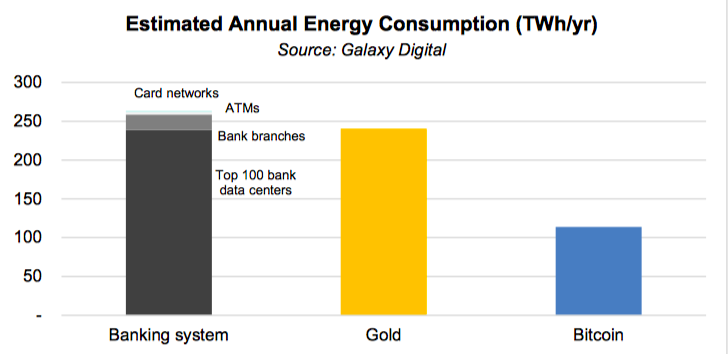

As per Galaxy’s gauges, the yearly energy use of Bitcoin remains at 114 TWh, while the financial business devours more than 260 TWh every year. In the midst of the progressing worries over Bitcoin’s (BTC) energy utilization, another examination expresses that the customary financial framework devours significantly more energy than the Bitcoin organization.

Michael Novogratz’s cryptographic money firm Galaxy Digital delivered a report Friday named “On Bitcoin’s Energy Consumption A Quantitative Approach to a Subjective Question,” giving open-source admittance to its strategy and estimations.

Ordered by Galaxy’s mining arm, the examination gauges Bitcoin’s yearly power utilization to remain at 113.89 TWh, including energy for digger interest, excavator power utilization, pool power utilization, and hub power utilization. This sum is in any event multiple times lower than the all out energy devoured by the financial framework just as the gold business on a yearly premise, as indicated by Galaxy’s assessments.

While Bitcoin’s energy utilization is straightforward and simple to follow continuously utilizing instruments like Cambridge Bitcoin Electricity Consumption Index, the assessment of energy use of the gold business and the customary monetary framework isn’t excessively clear, Galaxy Digital Mining expressed.

“The banking industry does not directly report electricity consumption data,”the report says, adding that the retail and business banking framework requires numerous settlement layers, while Bitcoin offers last settlement. Given Galaxy’s assessments of force utilization by banking server farms, bank offices, ATMs, and card organization’s server farms, the complete yearly energy utilization of the financial framework is assessed to be 263.72 TWh all around the world.

To figure the energy utilization of the gold business, Galaxy Digital Mining carried out gauges for the business’ absolute ozone depleting substances emanations gave in the World’s Gold Council’s report named “Gold and climate change Current and future impacts.” As assessed in the examination, the gold business uses generally 240.61 TWh each year. “These estimates may exclude key sources of energy use and emissions that are second order effects of the gold industry like the energy and carbon intensity of the tires used in gold mines,” Galaxy noted.

World Digital’s investigation on Bitcoin’s energy utilization comes in the midst of a significant crypto market slump that follows Tesla CEO Elon Musk’s choice to quit tolerating BTC as installment for vehicle acquisitions because of natural concerns. “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment,” the CEO composed on Twitter a week ago.

Musk’s move prodded wide-scale analysis from the crypto local area, with some expressing that SpaceX would need to switch it rockets to “more sustainable energy” in order to not “look like a clueless big hypocrite.”

Crypto markets shed more than $500 billion after Musk took to Twitter with his declaration, with Bitcoin today slipping beneath $43,000 interestingly since early February. The executive evidently carried more pressure to the market by implying that Tesla has plans to dump Bitcoin from its asset report soon.